In our previous article, we have discussed some frequently asked questions from the Punjab Civil Service Rules. In this article, we will discuss questions related to the Punjab Financial Rules. We hope you will find it useful. So let's begin:-

|

| Frequently Asked Questions |

Q-1: A mistake detected in the cashbook. How can it be rectified?

Ans: It should be rectified by drawing the pen through the incorrect entry and inserting the correct one in red ink between the lines. The head of the office that is DDO should initial this correction.

{Rule 2.2(vi) of the Punjab Financial Rules volume 1 part 1}

Q-2: A Govt. high school has drawn a cheque in favor of a supplier and deposited it in cash chest at the close of the year. Comments?

Ans: As per note 1 below rule 2.14 of the Punjab Financial Rules volume 1 part 1, It is a serious irregularity to draw cheques and deposit them in the cash chest at the close of the year for the purpose of showing the full amount of the grant is utilized. So the action of the school is against the rules.

Q-3: Please state the minimum amount for which cheques can be issued?

Ans: According to rule 2.15 of the Punjab Financial Rules volume 1 part 1, cheques shall not be issued for sums less than Rs. 100 unless it is permissible under the provisions of any law or a rule having the force of law for the disbursement of these and other charges which are naturally paid in cash.

Q-4: A cheque of Rs. 50,000/- drawn on 01-10-2019 was presented for encashment at the bank on 18-01-2020 was refused payment on the grounds having become time-barred as it was presented after the expiry of 3 months. Comments?

Ans: Cheques remain current for three months only after the month of the issue. So a cheque which was drawn on 01-10-2019 will remain current up to 31-01-2020. As such the action of the bank in refusing payment on the grounds that cheque becomes time-barred is against the rules.

Q-5: An arrear bill of pay for the month of January 2010 of Rs.33,675/- was presented at the treasury on 15-03-2001. The Treasury officer termed the bill as time-barred. Comments?

Ans: The action of the Treasury officer is in accordance with rule 2.25(a) of the Punjab Financial Rules volume 1 part 1, vide which claims/bills not preferred within a year of their becoming due become time-barred.

Q-6: The Head of a Department sanctioned 4 years assured career progression of an employee with effect from 01-07-2007 vide office order dated 15-06-2013. The arrear bill for the period from 01-07-2007 to 31-05-2013 was presented at the treasury on 21-06-2013. The treasury officer termed the bill as time-barred. Comments?

Ans: The action of the Treasury officer in rejecting the payment of the arrear bill by treating it as time-barred is against the provisions of explanation 4 below rules 2.25(h) of the Punjab Financial Rules volume 1 part 1, according to which the time limit of one year should be calculated from the date of sanction and not the date from which sanction takes effect.

Q-7: A DDO withdraws money against a contingent bill on 31-03-1990 in anticipation of material to utilize the budget grant, as no funds for the purpose have been provided for in the next year's grant. Comment?

Ans: As per rule 2.10(b)(5) of the Punjab Financial Rules volume 1 part 1, it is a serious irregularity to withdraw money from the treasury unless it is required for immediate disbursement. When the material has not been received before 31-03-1990, the question of drawing money from the treasury does not arise.

Further, as per rule 17.19 of ibid, it is also impermissible to draw advances from the treasury to prevent lapse of budget grant. So the action of DDO is against the rules.

Q-8: Due to the negligence of an employee of the revenue department the government had to suffer a loss of revenue to the extent of Rs. 50,000/-. It is proposed to recover the amount from the dealing hand. Comment?

Ans: According to rule 2.33 of the Punjab Financial Rules volume 1 part 1, every government employee should realize fully and clearly that he will be held personally responsible for any loss sustained by the government through negligence or fraud on his part to the extent the government has to suffer a loss. As such the proposal is in accordance with the rules.

Q-9: Can the Competent Authority recover Govt. dues from the General Provident Fund of a Govt. employee?

Ans: As per rule 2.46 of the Punjab Financial Rules volume 1 part 1, no recovery from the amount lying at the credit of an employee in his G.P. Fund is possible without his consent. So the competent authority cannot recover Govt. dues from the G.P. Fund of an employee directly.

Q-10: Whether the amount at the credit of a Govt. employee in his G.P Fund can be attached by a Court of Law?

Ans: No. The amount at the credit of an employee in his G.P Fund cannot be attached by a Court of Law.

{Rule 2.46 of the Punjab Financial Rules volume 1 part 1}

Q-11: When the bills for a monthly salary of Govt. employees can be signed by the DDO? When they shall be due for payment?

Ans: According to rule 5.1 of the Punjab Financial Rules volume 1 part 1 read with Government instructions dated 12-07-2002, the bills of monthly salary of Govt. employees may be signed at any time within 5 working days before the last working day of the month to which they relate. Such bills are due for payment on the first working day of the next month.

Q-12: It is ordered by the Head of Department to disburse the salary for the month of July on 31st July, as there are Gazetted holidays on 1,2 and 3 August. Comment?

Ans: The orders of the head of the department are against the provision of rule 5.1 of the Punjab Financial Rules volume 1 part 1 and Govt. instructions dated 12-07-2002 in this regard, vide which pay of July shall be due for payment on the first working day of August.

Q-13: A Govt. employee died in the morning at 3:00 A.m on 30th July. His claim for pay and allowance was prepared by the DDO for 29 days only. Please comment his action is as per rules or not?

Ans: The action of the DDO in drawing pay and allowances for 29 days only instead of 30 days is against the provisions of rule 5.3(a) of the Punjab Financial Rules volume 1 part 1. According to which pay and allowances can be drawn for the day of a person's death, the hour at which death takes place has no effect on the claim.

Q-14: Whether it is compulsory for a DDO to recover dues of co-operative societies from the salary of Govt. employee?

Ans: As per rule 5.9(g) of the Punjab Financial Rules volume 1 part 1, the dues of cooperative societies can be recovered from the salary of Govt. employee by the DDO only if the employee concerned gives in writing to effect such recoveries. The DDO before effecting such recoveries ensures that the authorization given to him is clear, unambiguous and has not been revoked.

Q-15: A higher authority proposed to appoint two clerks against one vacant post of superintendent on the plea that the expenditure will be less and work will run smoothly?

Ans: The proposal of the higher authority is against the provisions of rule 7.15 of the Punjab Financial Rules volume 1 part 1. According to this rule for one vacancy in a higher unit or cadre only one extra post in a lower unit or cadre is admissible.

In the end, we hope this article will surely help you in increasing your basic knowledge about the rules. If you still have any kind of doubt or query you can comment in the comment box or contact directly by filling "Contact Form" on the right side.

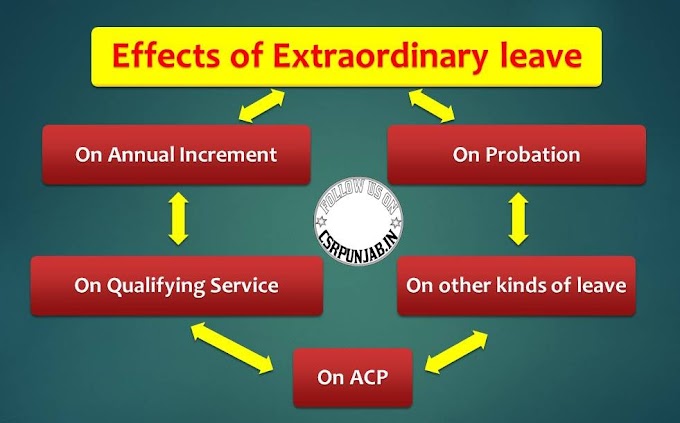

You can also read Frequently asked question answers Part-1, How can you avail 10 days leave encashment

Ans: As per rule 5.9(g) of the Punjab Financial Rules volume 1 part 1, the dues of cooperative societies can be recovered from the salary of Govt. employee by the DDO only if the employee concerned gives in writing to effect such recoveries. The DDO before effecting such recoveries ensures that the authorization given to him is clear, unambiguous and has not been revoked.

Q-15: A higher authority proposed to appoint two clerks against one vacant post of superintendent on the plea that the expenditure will be less and work will run smoothly?

Ans: The proposal of the higher authority is against the provisions of rule 7.15 of the Punjab Financial Rules volume 1 part 1. According to this rule for one vacancy in a higher unit or cadre only one extra post in a lower unit or cadre is admissible.

In the end, we hope this article will surely help you in increasing your basic knowledge about the rules. If you still have any kind of doubt or query you can comment in the comment box or contact directly by filling "Contact Form" on the right side.

Please follow our website for more updates.

You can also read Frequently asked question answers Part-1, How can you avail 10 days leave encashment

![Joy to Unicode Converter[Convert Joy font to Unicode Font]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEh3f8Zg_5htGD-hVKzVHogU5W5OWZ5UtcKdg97w_pk3C20rO_YjhEiIh2PJtq34jm82Ao-puIVE2hvXwasUYc12w-1Vu5C_ytqbKjHJ_79U9tarTLJbzbR3VSDpCtqKk4QsjxVJTTxZF70/w680/joy-to-unicode-converter.webp)

7 Comments

The employee has got the job in the year 2020 with Notional Benefits from the year 2007 through the orders of the Hon'ble Punjab and Haryana High Court. Can he get earned leaves and medical leaves from 2007?

ReplyDeleteYes if the court orders to count previous for all benefits of service then leaves will be countable from 2007

DeleteThe teacher of education department has been transferred from one district to another district. Will he have to give up his seniority or not?

ReplyDeleteCheck your department seniority rules. I think your seniority is not at district level it is upto State Level

DeleteThe employee should have taken 2 months medical leave but he does not have the balance of medical leave. The salary was paid by the DDO while accepting the leave but after the DDO came to know about it, the salary of the employee was recovered and deposited in the treasury. Can any action be taken against DDO as per rules?

ReplyDeleteAs per rules show cause notice may be given to DDO. But otherwise it depends upon the higher authority and also depends upon the concerned employee, if he not complaining against this issue to anyone. Whereas leave not due may be granted in this and thus the employee becomes eligible for half pay.

DeleteIS IT COMPLUSORY FOR MEDICAL CERTIFICATE FOR ONE DAY MEDICAL LEAVE? AND IS IT COMPLUSORY TO ATTACH THE MEDICAL CERTIFICATE FOR HALF PAY LEAVE?

ReplyDelete