Many of the employees who have the responsibility of depositing development tax are facing difficulties in the Generation of Development tax Challan. Because when we are trying to generate challan on the Cyber Treasury Portal, Punjab an error has been generated every time. Due to this, Challan has not been generated.

The main reason that the Government of Punjab has transitioned to a new IFMS w.e.f. 1.4.2020. Now you can Generate the Challan of Development Tax on https://ifms.punjab.gov.in/eReceipt/. Let’s start the whole procedure of Generation of Development Tax Challan.

Process of Generation of Development Tax Challan

- Go to https://ifms.punjab.gov.in/eReceipt/

and a webpage will be displayed like this:-

- Click on Signup and a window will be shown as below:-

- In "Select Id and Password" fill the information as per your own choice. For example, if the office name is Municipal Corporation, Mohali then you can set your login id as mcmohali and set a password of your choice.

- In "Personal Detail of User" fill the information as per your office. By using the above example we will the information as below:-

- First Name= Municipal Corporation

- last Name= Mohali

- D.O.B= Fill date of birth

- Email= Fill your official Email.

- Address= Fill your office Address(Note Don't use special characters like comma(,), Dash(-) or Full Stop(.), etc.)

- City= Choose your office district.

- State= Punjab

- Mobile No.= Enter mobile number.

- PINCODE= Office Pincode.

- Select the Security question of your choice and in Answer fill the answer of your own choice.

- In the end, enter the result of Mathematical Equation and click Submit.

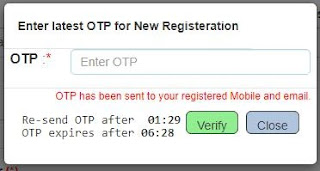

- When you click on submit, a one time password will be sent to your email id and mobile number. Now fill this OTP and click the verify button as shown in the picture below:-

- When you verify it after entering OTP. A welcome screen will be displayed like this:-

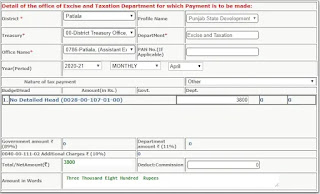

- Now in Department list Select Excise and Taxation-PET and in MajorHead Select 0028-Taxes on Income and Expenditure. Set the Profile name as "Punjab State Development Tax" and from the box provided below click on 0028-00-107-01-00 as displayed in the image below:-

- Click on Submit. Your data will be saved successfully.

- Now a profile will be created as shown in the picture below:-

- Now click on make payment and fill the required information as shown in the picture:-

- Now in Payment Detail choose the type of payment as per your requirement that is Manual or Ebanking. If manual then choose Cash or Single Cheque or Multiple Cheques. We are here choosing Cash option and in Name of Bank selecting State Bank of India.

- After this, in Personal Detail, most of the textboxes are prefilled. Only enter your district name in Town/City/District and in the end, click on Submit.

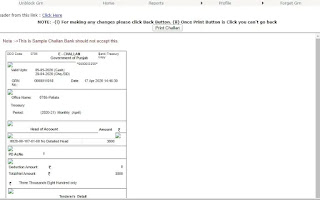

- After some processing at the back end, a new window will be displayed to print Challan like this:-

- Now click on Print Challan and your challan will be opened in a new window as shown in the picture provided below:-

Development Tax Challan print - Now after taking print out of Challan. You have to fill two things manually. The first one is in front of Treasury write 00-District Treasury Office, Patiala and the second is in Candidate Detail write your office PAN.

- That's all.

Please note Generate Challan as per next article Generation of Development Tax Challan

![Joy to Unicode Converter[Convert Joy font to Unicode Font]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEh3f8Zg_5htGD-hVKzVHogU5W5OWZ5UtcKdg97w_pk3C20rO_YjhEiIh2PJtq34jm82Ao-puIVE2hvXwasUYc12w-1Vu5C_ytqbKjHJ_79U9tarTLJbzbR3VSDpCtqKk4QsjxVJTTxZF70/w680/joy-to-unicode-converter.webp)

4 Comments

hi

ReplyDeleteis it necessary to fill the mobile number of concerned head of the department??? or we can update any mobile number ???

It's your choice. Whatever the mobile number provided by you an otp will be sent to that mobile number and also it will help in case of recreation of password

ReplyDeleteHello

ReplyDeleteFor Government School to pay development tax we need to make id of school first.

can we pay previous year 2019 development tax now.

In your case responsibility of deposition of development is of treasury. You have to just forward schedule of development tax deduction like other salary bills.

Delete